Economic model

An open value network embodies new processes for innovation, production, distribution and capturing of benefits. The underlying economic model depends on the type of value network.

This page only contains general considerations.

Read also Open Value Network: A framework for many-to-many innovation

About production

OVN's are commons-based peer production systems. When we think of peer production, we think of a new, self-sustaining system of production of resources.

Peer production: Is a way of production of goods and services that relies on self-organizing networks/communities of individuals. In such networks/communities, the actions of affiliates or agents is coordinated towards a shared outcome, while facilitating access to the resources required in the process. It describes a new model of socio-economic production in which the labor of individuals is coordinated (usually with the aid of the Internet) mostly without traditional hierarchical organization. Wikipedia

Commons-based peer production: Is a subset of peer production alluding to new regimes of property and resource access rules. In order to accelerate innovation and the flow of resources within the network/community, towards hubs of production, resources are turned into commons. Within the Sensorica OVN affiliates distinguish between Commons, reserved for shared immaterial assets, and Pool of shareables, reserved for shared material assets. We also need to note that commons-based peer production contains two terms that are associated with two very different political economy movements. The commons side is closer to the traditional left, to communitarism, and puts the emphasis on sharing. The peer side is closer to the traditional right, to libertaniarism, and puts the emphasis on individual freedom and autonomy. Hence commons-based peer production announces a compromised tension between the two tendencies, increasing individual freedom and autonomy by putting in place new property regimes, new rules for access and use of resources. Commons-based peer production is often used interchangeably with the term social production. Wikipedia

See peer production on P2P Foundation.

About resources

OVNs are unbounded structures when it comes to resources. Since the network is transparent (in terms of access to information) and open (in terms of access to participation), it can always attract new affiliates who are willing to make different types of contributions: time, cash, materials (tools and equipment, physical spaces), social capital, etc. In that sense, the network is not bounded by a limited pool of resources (budget or a given number of employees) like classical organizations are. Its resources can expand very dynamically according to needs and incentives.

It is important to understand that resources are used by agents in peer production processes. Peer production is a process of co-creation or co-production. Unlike in traditional settings, in which the process of creation relies on exchanges (labor against tangible benefits, money for example), leading to the enclosure of the output by the entity that assumes the risk (the investors in the company for example), co-creation processes rely on contributions, shared risk, as well as shared output. Thus, human assets are not commodified, because they are not exchanged during the co-creation process. Labor is not commodified in peer production. No one is working for anyone else.

Property

Different forms of property are used within the OVN: private or individual property, shared property, nondominium and communs.

Material contributions and private property: Affiliates can contribute to processes, in the context of a venture, with their material assets (ex. physical space, equipment, tools, consumable materials, etc.). These assets can be listed as available for use in a pool of shareables. The notion of individual ownership can be preserved and the owners can set the rules of access/use in order to protect their assets. The use of these assets is considered as a contribution. It is important to note that there is no exchange in a material contribution process, as in renting an asset. Also, there is no debt generated towards the owner, incurred by the venture for using the asset. Some have advocated a hybrid model of exchange + contribution). We can see the pool of shareables as an amalgamation of individually owned material assets to serve in process. This concept of material contribution can be extended to shared property, in which case the contribution is attributed to all co-owners, and the benefits that may follow from it will be split among all the co-owners, based on a scheme of their choice.

Individually owned or co-owned assets can also be transferred to a trust, usually a non-profit organization, a Custodian in OVN language. In this case, the Custodian becomes the legal owner of these assets and protects them from enclosure (being seized by other private interests), while making them available to all OVN affiliates, based on a set of rules. This is the nondominium form of property, which is also extended to immaterial assets, like brands for example. Formally speaking, the custodian signs a custodian agreement by which it obliges itself to manage these assets in the interest of all OVN affiliates, and promises to transfer all the assets it holds for the OVN to another entity, if OVN affiliates aren't satisfied with its services, under the same nondominium regime.

Digital assets (ex. documents, presentations, design files, software, pictures, videos, etc.) produced by the OVN are shared under some type of open/free or Creative Commons license, and become part of the OVN's commons. Commons in digital form doesn't require a lot of resources for management or maintenance. Moreover, their distribution cost is nearly zero. Thus, these are shares assets that don't require much governance to process.

See [CAKE], the Custodian of Sensorica.

Types of resources

See also Resource types in the context of the value accounting system

Human resources

OVNs are open (in terms of access to participation) and transparent (in terms of access to information), and run on an Internet-based platform. OVNs that focus on high tech products (material of software) can operate on the [1] long tail mode of production, meaning that they can integrate a large number of agents distributed across the planet. In other words, their pool of participants is practically the world's population.

See also the Role system, Reputation system - [NOTE to participants: expand on this...] discussion for this page

Motivation and Incentive system

OVNs embody a motivation and incentive system, which sends specific signals that connect the required efforts and responsibility to benefits of different types, including fluid equity. The function of this system is to build and maintain awareness about the purpose, meaning, and importance of each affiliate’s actions. It is designed to make affiliates conscious about why they are doing what they are doing and to link that to benefits.

The incentive system describes a game, setting up the rules that link contributions to tangible benefits. OVN's do that through the benefits distribution algorithm. Central to designing such games is the notion of fairness. Agents engage in games that they consider fair, that treat every player according to them same standards. This is a clear departure from traditional labor theory of value and the utility theory of value, which represents a departure from capitalism and communism/socialism.

Affiliates of Sensorica have responded to extrinsic incentives. One example is the revenue generated by affiliates that engage in commercial activities. The OVN uses a contribution accounting system to record and evaluate contributions (time, cash, materials...) and some type of benefits distribution algorithm to compute how benefits are redistributed to contributors. A second example is the access to a variety of assets, to materials, tools and equipment, as well as to a pool of talent. A third example is the access to a context for technical and scientific research, allow agents to apply their knowledge, prototype their ideas, create new ventures and accelerate the development process of new products and services.

Sensoricans have also responded to intrinsic incentives. Some affiliates are driven by the interest or enjoyment in the tasks they take, without being subject to any external pressure. Others appreciate the learning opportunities while contributing to ventures. Some affiliates seek recognition from their peers, which comes in the form of formal reputation within OVNs, and is publicly exposed from profiles. OVNs are highly collaborative environment, where individuals share and help each others, which can provide great satisfaction. OVNs also cultivate a high sense of individual autonomy. Since OVNs are transparent (in terms of access to information) they are biased towards ethical behavior, which provides a good alignment with some individual values. The openness (in terms of participation) of OVNs makes them grow around widely accepted values. For this reason, ventures are often attached to solving important social problems. The mobility within the OVN, and the unrestricted exposure to all the activities give affiliates the possibility to grow their skills and experience.

NOTE: The above text was adapted from the IGC-HEC case. It was produced by Mai Thai (prof at HEC) in collaboration with Sensorica affiliates.

Currency

The OVN operates on peer-production, co-creation, relying on contributions, risk-sharing and expecting a portion of benefits in proportion to one's contributions. A contribution accounting system is used to keep track of contributions, and describes how they amalgamate into a product. There are no exchanges in a process of co-creation, therefore there is no need of a currency for internal processes, in a pure peer-production system. But hybrid models have already been advocated by others.

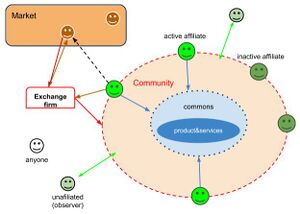

OVNs exchange their products with the market through the Exchange firm. Different exchange mechanisms can be used: barter systems or different types of currencies. Tangible rewards that flow back into the OVN is called revenue. All revenue is immediately redistributed to affiliates based on their contributions or fluid equity, using the contribution accounting system. A portion of that goes to maintain the infrastructure. Affiliates use a portion of their revenue to invest back into ventures, as a financial contribution.

We can discuss about current-see in this context.

Knowledge commons

See Commons

Resource allocation

An OVN is decentralized in terms of allocation of resources. In other words, most of the resources used in its processes are provided by affiliates, in the form of investment. Some of them come from the commons, or the pool of shareables. Like in traditional open source projects, every affiliate decides where to allocate resources for reasons that are purely individual and/or collectively agreed upon. In the pure p2p form there is no budget for venture development. If cash is needed for something (pay for a service or for a piece of equipment, if it can't be sourced within the network as a contribution) a crowdfunding process is used, and those who participate can decide to turn that into a financial contribution.

In practice, Sensorica has used grants, which have gone into a shared funding pool, a budget, administered by a Custodian, with input from affiliates .

Crowdfunding a venture also produce a shared pool of money before a product reaches the market, and needs to be managed by the venture's affiliates. The custodian offers financial services to ventures, by holding the money in its bank account and administer it according to the collective will of venture affiliates.

The nondominium is a centralized pool of resources, but only centralized in terms of ownership (it legally belongs to a Custodian, guaranteeing access to affiliates. The rules that govern this access (to use) are decided by affiliates through some democratic process. The network also decides how much to allocate for maintenance, replenishment, and new acquisitions of shared material assets. The maintenance and management is also done by the network. In order to incentivize maintenance, a % is extracted from revenue generated by commercial activities that use these assets, and it is used to pay for the work. The Custodian is not allowed to exploit these resources (extract rent or generate revenue by using them in any way shape or form).

About marketing

OSH Start-ups’ Business Development Challenges: The Case of Sensorica from a Total Integrated Marketing Perspective, by Normand Turgeon, Mai Thi Thanh Thai, Gheorghe Epuran (temporary restricted to Sensorica members).

From a service perspective

.

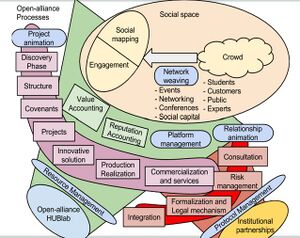

OVN ecosystem mapping

.

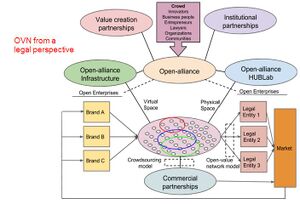

OVN from a legal perspective

.

OVN interfaces

.

About entrepreneurship

Products and services

OVNs are transparent in terms of access to information about products and internal processes. That erases the informational asymmetry often seen between corporations and their market. This informational asymmetry gives raise to abuse, higher prices and unethical practices. Among other things, this makes possible programmed obsolescence and deliberate environmental negligence. On the other side, transparency incites for better practices and increases accountability. In the current economy, OVNs can capitalize their higher ethical standards, which are a corollary of their openness and transparency, and can charge a premium on their products, to recover a portion of the loss due to the informational symmetry (which reduces the bargaining power).

Because of transparency the product design philosophy fits better the widely accepted norms. Openness, which allows a larger participation to the design process can result in products of higher value (higher quality, user friendly, environmentally friendly, interoperable, etc.).

See Sensorica's product design philosophy document.

See How to play the open game in the present and future economy

Clients

The OVN integrates a lot of feedback from clients by maintaining an open communication channel with them, like in the case of open source projects with users. Clients are also invited to become contributors to the network, or network affiliates. Unlike traditional companies, OVNs reward feedback through the contribution accounting system in a tangible way, if this feedback adds value to the network in a tangible way (in terms of product design, improvement of internal processes, etc.).

Strategy

add content...

Organizational design

The OVN is designed to be a commons-based production system in which a network of members work together to create and market products under a Creative Commons license commons. The knowledge on which commons products are built is open. Most processes within the OVN are in the open and transparent to outsiders.

Although the OVN’s products are created by individual members, the exchange with the market must be performed in the name of the community, for the community. Members are not allowed to complete transactions with the market. Rather, they have to pass through an Exchange firm. This policy helps alleviate two problems. First, members might be tempted to cheat for large deals and not disclose the full amount. The Exchange firm allows the community to know exactly the market value the product service is exchanged for. Second, some members can monopolize the interface with the market, through which they can gain disproportionate influence within the community. The Exchange firm facilitates members’ interface with the market and ensures that members have equal chance to access the market.

None of the members is paid any salary but they share profits from successfully commercialized products and can conduct their own business outside the OVN. Contributors of each product collectively decide the value of each type of contribution and thus the share of the revenue. These contributors are called affiliates. Anyone who promises to create a product or to increase the market value of an existing product can become an active affiliate. Active affiliates are individuals or organizations with resources and technical skills (e.g., hardware, software, optics, biology, etc.) as well as business skills (e.g., marketing, accounting, community building, etc.) that take part in the business cycle of a product from R&D (research and development) to sales and after sales service. However, people offering simple services only are not eligible to become active members. For example, machining a mechanical piece from a 3D model made by an active affgiliate does not quality the service provider to be an active affiliate because this service does not increase the market value of the product.

The OVN may produce a lot of commons but only some of these products are expected to have real market values. Affiliates are not awarded for ideas or non-used products/processes. They get revenue only when the final products get sold. Product development as well as financing and marketing the final product are the responsibility of active affiliates. Any affiliate can take the lead at his/her own initiative at any stage of the value chain from product development to distribution. Active affiliates must assume the task of persuading other affiliates to engage in their venture and/or use the results of their work in the next activities in the value chain. At any stage of the value chain, active affiliates can decide whether source/develop upon an existing product/process from within the OVN or from the market. On the same token, they can decide to sell their work at any stage or get their work used in the next stage. It should be noted that only work whose results get used is compensated when revenue flows back to the value chain. OVN affiliates understand that failure is a part of R&D processes and thus failures for good causes are rewarded by in the form of reputation building. Furthermore, activities with high risks of failure are given higher weight in the value equation with which active affiliate calculate the share of each affiliate’s contribution toward the product/process sold.

Redistribution of revenues from each product is calculated by the OVN’s value accounting system – a part of the OVN’s infrastructure entirely under the control of OVN’s active affiliates. The value accounting system is made of the value, reputation and role systems that interact with each other (Figure 2).

Each affiliate's activity types are recorded in a role system; the quantity of each member’s contribution is recorded in a value system; and the value of each contribution is quantified a value equation collectively decided by contributors of the product. The role of affiliates within the network is emergent (it is not assigned). As a result, the role system incites voluntary subordination and is important for self-organizing. The reputation of each affiliate is the result of peer-evaluation, by all other affiliates, taking into consideration the role played. The evaluation focuses on performance, behavior, drive, etc. The reputation is connected to the value system and affects the ability of an affiliate to extract value from the network. The reputation system incentivizes good behavior within the network and helps to focus attention. Therefore, the reputation system plays an important role in the creation and the flow of value within the network by filtering participants for adequate tasks. Sensorica’s experience with this value accounting system has been positive.

NOTE: The above text was copied from the IGC-HEC case. It was produced by Mai Thai (prof at HEC) in collaboration with Sensorica affiliates.

Infrastructure

See the Infrastructure page

External resources

IGC-HEC case on Sensorica

See event summary Open database of studies and papers !!!Access temporary restricted to Sensorica affiliates, contact Tibi, Francois or Ivan!!!

Growth model

Network level

An OVN grows by affiliation. It's size is only limited by coordination. In terms of infrastructure, for every venture that creates exchange value a contribution accounting system is used to describe how value amalgamates into a product. Products of some ventures can represent inputs for other ventures, in which another value accounting system is used.

Network of networks level

The infrastructure of OVNs is designed to be applied to fractal structures, or Network of Networks. An OVN can be considered as an individual contributor in a venture in another OVN . Some have used the term super-value network. In theory, the OVN concept can be applied to the entire global economy.

We are thinking about value accounting at the venture level, which is federated at the network level and use a protocol for inter-network exchanges and co-creation.

We observed around Sensorica 2 growth modes for Network of Networks.

- by affiliation - independent networks that already exist affiliate with other networks. See work on the Open Alliance.

- by incubation and spin off - individuals with project ideas join a network, grow their venture, which become sub-networks, use local resources to develop and are spun off once they reach critical mass. This is the case with Drone and 3D Printing projects in Sensorica.

We are now thinking about giving OVNs the internal mechanisms to nest and incubate embryo networks to be spun off later.

Papers on Sensorica

- OSH Start-ups’ Business Development Challenges: The Case of Sensorica from a Total Integrated Marketing Perspective, by Normand Turgeon, Mai Thi Thanh Thai, Gheorghe Epuran (temporary restricted to Sensorica members).